Exploring the Advantages of Offshore Trust Property Protection for Your Wide Range

When it involves safeguarding your riches, overseas trust funds can supply significant advantages that you might not have thought about. These depends on give a critical layer of security against financial institutions and lawful insurance claims, while additionally enhancing your privacy. And also, they can open up doors to special financial investment opportunities. Curious about just how these advantages can impact your economic future and estate planning? Let's discover what offshore trust funds can do for you.

Understanding Offshore Trusts: A Guide

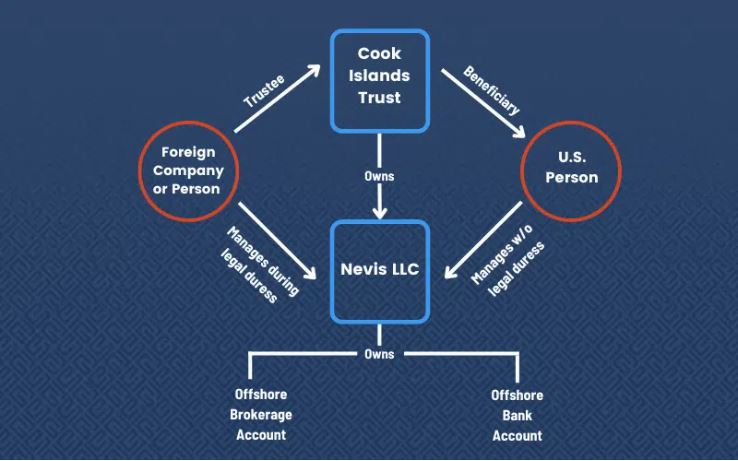

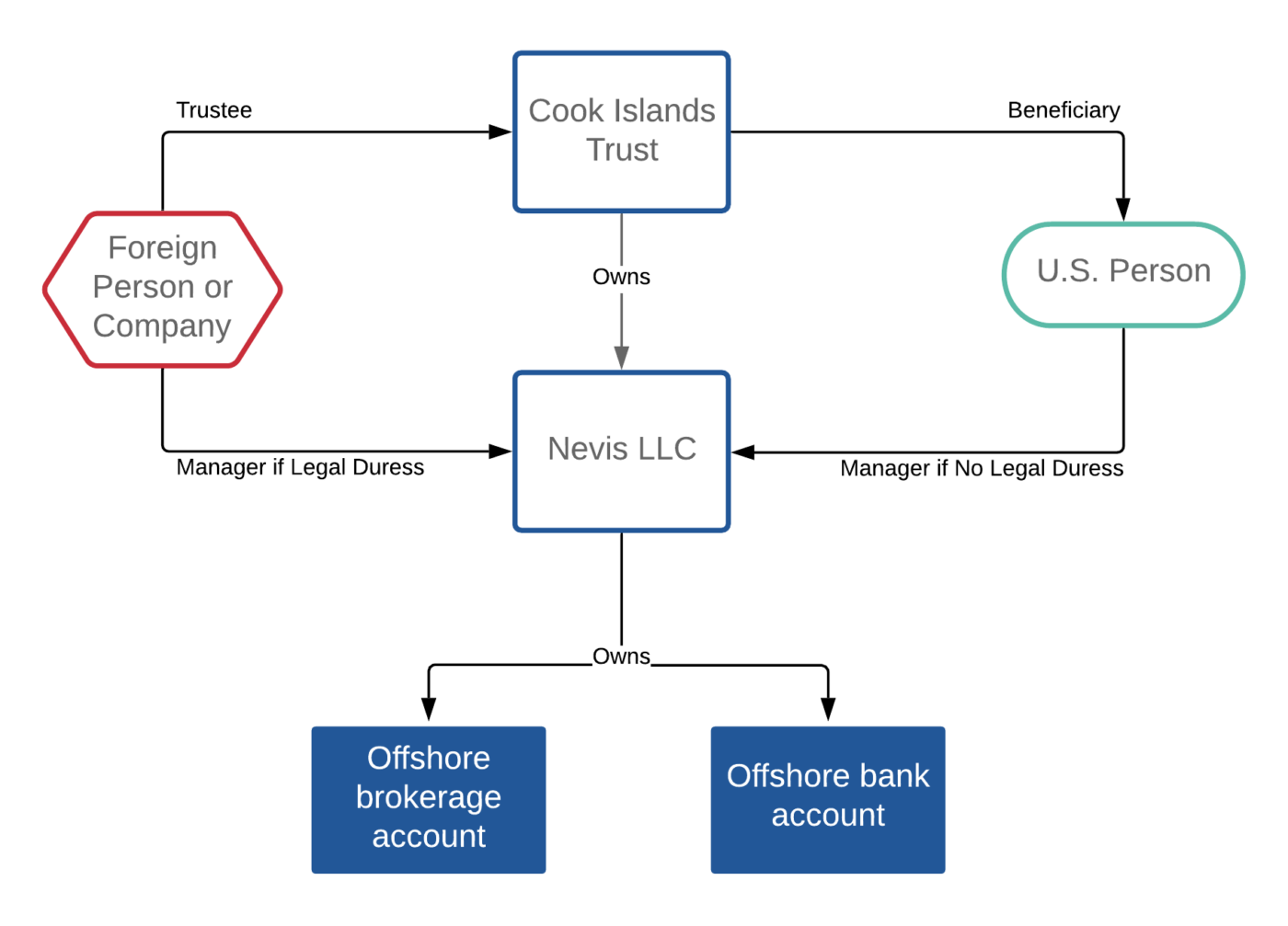

Offshore depends on offer a distinct way to take care of and safeguard your properties, and recognizing their fundamentals is important. When you established up an offshore count on, you're essentially moving your properties to a trustee, who manages them according to your specified terms.

You can personalize the trust fund to fulfill your certain demands, such as picking recipients and dictating exactly how and when they get circulations. In addition, offshore counts on usually provide confidentiality, shielding your monetary affairs from public examination. By comprehending these basics, you can make enlightened choices concerning whether an overseas depend on lines up with your property defense method and long-lasting economic objectives. Recognizing this device is a crucial action towards safeguarding your riches.

Lawful Defenses Provided by Offshore Trusts

When you develop an offshore depend on, you're taking advantage of a durable framework of lawful defenses that can protect your assets from numerous risks. These counts on are frequently controlled by positive regulations in offshore jurisdictions, which can supply stronger defenses versus creditors and lawful insurance claims. For instance, numerous overseas counts on gain from legal securities that make it hard for creditors to access your properties, even in personal bankruptcy situations.

In addition, the splitting up of lawful and valuable possession means that, as a beneficiary, you do not have straight control over the assets, making complex any type of attempts by creditors to take them. Many overseas jurisdictions likewise restrict the moment framework in which claims can be made against depends on, including an additional layer of safety and security. By leveraging these lawful defenses, you can greatly enhance your economic stability and protect your riches from unanticipated dangers.

Personal Privacy and Discretion Conveniences

Developing an overseas trust fund not only offers robust legal defenses but likewise ensures a high level of privacy and confidentiality for your possessions. When you set up an offshore count on, your economic affairs are shielded from public analysis, aiding you keep discretion regarding your wealth. This confidentiality is important, particularly if you're concerned about possible legal actions or unwanted attention.

In many offshore territories, regulations secure your individual information, indicating that your possessions and monetary dealings continue to be exclusive. You will not have to fret about your name appearing in public records or monetary disclosures. In addition, working with a respectable trustee ensures that your information is taken care of firmly, additional improving your personal privacy.

This degree of privacy enables you to manage your wide range without concern of direct exposure, giving tranquility of mind as you protect your economic future. Eventually, the privacy benefits of an overseas depend on can be a significant advantage in today's increasingly clear world.

Tax Obligation Advantages of Offshore Trust Funds

One of one of the most engaging reasons to ponder an offshore depend on is the potential for considerable tax obligation advantages. Setting up an overseas trust fund can assist you minimize your tax liabilities lawfully, depending on the jurisdiction you pick. Several offshore territories offer favorable tax rates, and in many cases, you might also take advantage of tax exemptions on earnings produced within the trust fund.

By moving properties to an overseas trust fund, you can divide your individual riches from your gross income, which might reduce your overall tax burden. Furthermore, some jurisdictions have no funding gains tax, permitting your investments to expand without the immediate tax effects you would certainly deal with domestically.

Property Diversity and Financial Investment Opportunities

By producing an offshore depend on, you unlock to asset diversity and special financial investment possibilities that might not be available in your house nation. With an offshore trust fund, you can access various international markets, allowing you to invest in realty, stocks, or commodities that may be restricted or less favorable locally. This worldwide reach helps you spread out danger across various economic climates and markets, protecting your wealth from local economic declines.

Furthermore, offshore depends on commonly offer accessibility to specialized financial investment funds and alternative properties, such as exclusive equity or bush funds, which could not be readily available in your home market. This critical strategy can be essential in protecting and expanding your wide range over time.

Succession Preparation and Riches Transfer

When thinking about just how to pass on your wealth, an offshore trust fund can play a vital role in reliable sequence planning. By developing one, you can guarantee that your possessions are structured to attend to your enjoyed ones while reducing prospective tax implications. An offshore trust fund permits you to dictate how and when your beneficiaries obtain their inheritance, offering you with comfort.

You can appoint a trustee to handle the trust, ensuring your wishes are performed even after you're gone (offshore trusts asset protection). This arrangement can also safeguard your properties from financial institutions and lawful difficulties, safeguarding your family's future. Additionally, offshore depends on can provide personal privacy, maintaining your monetary issues out of the general public eye

Eventually, with cautious planning, an offshore depend on can act as an effective tool to assist in riches transfer, assuring that your legacy is maintained and your loved ones are looked after according to your dreams.

Choosing the Right Territory for Your Offshore Count On

Selecting the right jurisdiction for your offshore trust is a key consider maximizing its advantages. You'll intend to contemplate variables like legal framework, tax obligation effects, and asset security regulations. Different territories supply varying levels of privacy and security, so it is vital to research each option thoroughly.

Seek places understood for their desirable trust legislations, such as the Cayman Islands, Bermuda, or Singapore. These jurisdictions usually offer durable lawful protections and a reputation for economic safety.

Additionally, think of availability and the convenience of handling your depend on from your home country. Consulting with a lawful expert specialized in offshore depends on can lead you in steering with these intricacies.

Eventually, choosing the perfect jurisdiction can improve your asset security approach and ensure your wealth is safeguarded for future generations. Make educated choices to secure your economic tradition.

Regularly Asked Concerns

Can I Set up an Offshore Count On Without an Attorney?

You can practically establish up an overseas trust without a legal representative, however it's dangerous. You could miss crucial lawful subtleties, and issues can occur. Employing an you can try these out expert guarantees your trust follows policies and protects your passions.

What Happens if I Transfer To An Additional Nation?

Are Offshore Trusts Legal in My Nation?

You'll need to examine your neighborhood legislations to identify more information if overseas depends on are lawful in your nation. Rules differ widely, so consulting a lawful expert can assist assure you make notified decisions regarding your properties.

Exactly How Are Offshore Trusts Regulated Globally?

Offshore trust funds are controlled by global legislations and standards, varying by jurisdiction. You'll discover that each nation has its very own guidelines relating to taxation, reporting, and conformity, so it's vital to recognize the specifics for your situation.

Can I Accessibility My Assets in an Offshore Depend On?

Yes, you can access your assets in an offshore trust fund, yet it depends on the trust fund's framework and terms. You need to consult your trustee to understand the particular processes and any kind of restrictions entailed.

Final thought

To sum up, overseas depends on can be a clever option for protecting your riches. When thinking about an overseas trust fund, take the time to choose the best territory that aligns with your objectives.

Comments on “Diversify your financial defense using tried-and-true offshore trusts asset protection tactics.”